Don’t be hampered by slow coaches’ excuses

06.05.19 · Coach Insurance

Passenger fleet managers are hampered in attempts to manage and contain claims by a plethora of reasons and excuses for not reporting claims swiftly, says specialist bus and coach commercial insurance broker, McCarron Coates. This leads to hugely inflated costs per claim, which then has the knock-on effect of significant premium increases.

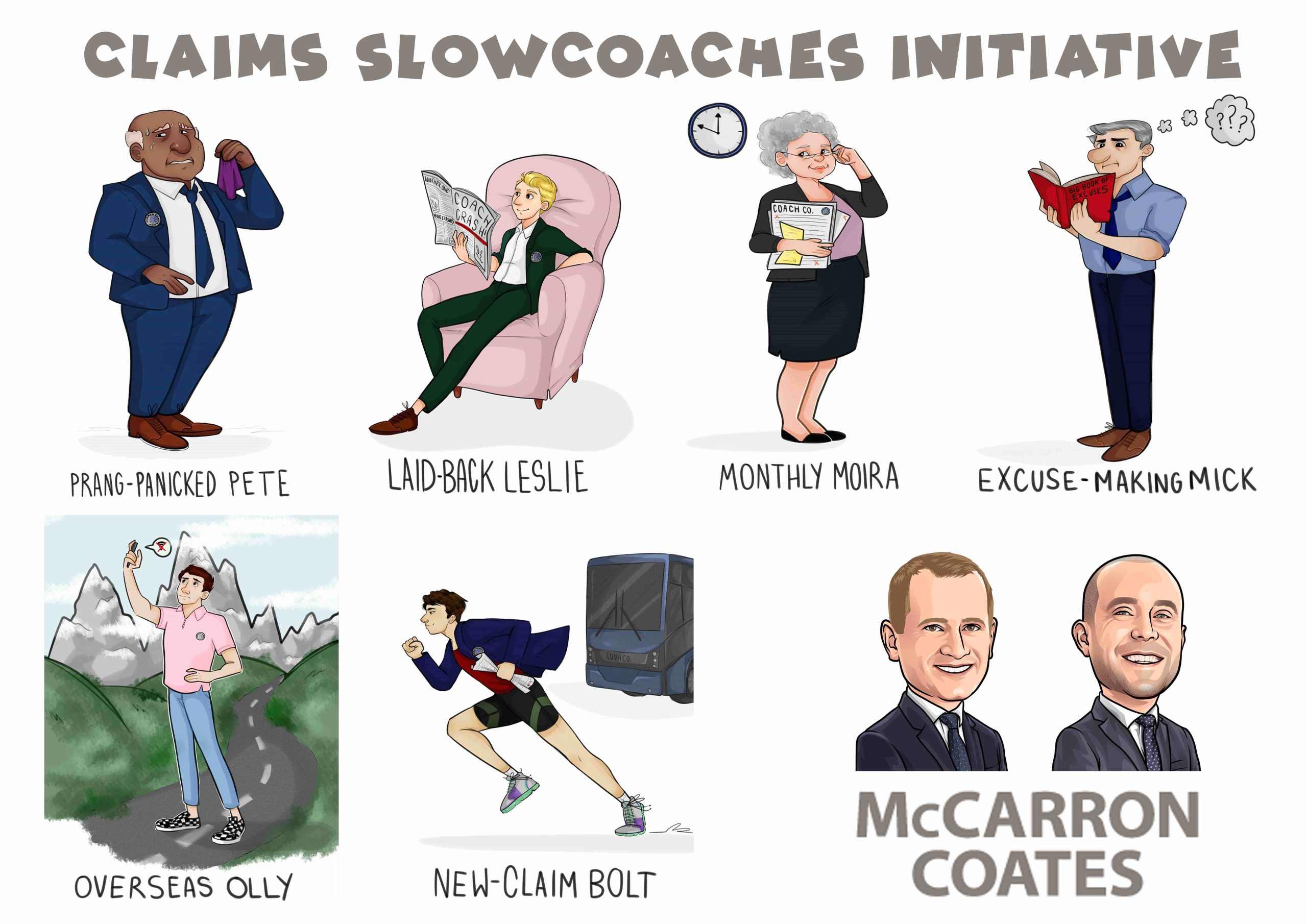

To help fleet managers tackle delayed claims reporting, McCarron Coates has created avatars to depict the personality types who may not report a claim immediately. It hopes these will help operators eradicate late reporting, tackling issues caused by drivers, administrators or even themselves. By noting the avatar scenarios, fleet managers should be able to put measures in place to get claims submitted speedily.

The Prang-Panicker (6 hours)

The Prang-Panicker feels extremely guilty about having had a bump and has to find the courage to make the incident known to their fleet manager. That takes them a good few hours, which means the other party’s insurer may have gained control of the claim, sending costs escalating, especially if they have been given a luxury hire car and already booked their physio appointments.

Fleet manager action:

Make sure your drivers know you would rather know about an incident swiftly, than have them worrying about what your reaction will be. After all, things happen to the best of us.

Laid-back Lesley (24 hours)

Laid-back Lesley doesn’t do anything in a hurry, working to their own schedule. By the time they get around to report an incident, the claims’ ball is well and truly in the court of the other insurer, which means the cost of vehicle repair, car hire and personal injury has already racked up.

Fleet manager action:

Drill into drivers the importance of fast-reporting and the dim view you will take of lazy attitudes towards this. Use visual reminders, placing these in the cab if necessary, and build claims reporting procedures into staff training and inductions.

Overseas Olly (48 hours)

Overseas Olly is wandering through the Alps, so surely cannot be blamed for not reporting a crash, when he has neither wi-fi connection nor signal and is in a different time zone? Knowing this will get him off the hook, he only files a report when it’s a good time in his itinerary. He’ll be down at sea level in a couple of days and is blissfully unaware that a hungry personal injury lawyer is already on this case, pursuing a much-inflated claim for the third-party driver who, unlike Olly, somehow skated off and found a signal just a little bit further down the road!

Fleet manager action:

Make it clear to drivers heading overseas that you want fast claims reporting 24 hours a day, 365 days a year and that, should a phone or wi-fi connection let them down, they need to get to a landline fast. Highlight that time-zone differences are not excuses that will cut the mustard.

The Excuse-Maker (14 days)

The Excuse-Maker is definitely at fault for their accident, so has to get their story straight before reporting it, to try to wriggle out of the mess they’ve landed themselves in. Making up excuses can be a longish process, so this individual only reports their incident once a good excuse comes to mind. Then, they make matters worse by disputing liability, which means the claim is dangerously close to going beyond the 15 days allowed for confirming where liability lies. If it does, there will be costly legal wrangling.

Fleet manager action:

Do not tolerate excuse-making and encourage honest reporting. If drivers try to absolve themselves of blame, it will simply cost you more in the long run. Consider giving them driver training in any areas of weakness, turning them into a better risk.

Monthly Moira (up to 30 days)

Monthly Moira runs the office with a rod of iron and is super-efficient (to her way of thinking), in collating all claims information and then reporting it in one fell swoop at month end. Little does Moira realise this is costing her employer huge sums on insurance premiums, because every claim becomes unnecessarily inflated. If she saw the figure, she’d be horrified! If her employer sees it, Moira’s days at the helm could be numbered!

Fleet manager action:

Stress to administrators that every claim should be reported as fast as humanly possible and that efficiency means ensuring drivers have their phones charged, the right reporting numbers to hand and all relevant details about the incident, the other party, their contact details and their vehicle registration number noted down.

New-Claim Bolt (-30 mins)

This is the driver every fleet manager or operator should want in their fleet – one who is quick out of the blocks when reporting a claim. New-claim Bolt leaves the third-party standing on the start-line whilst he gets his claim over the line and dashes through the red-tape. That just saved his fleet manager a pretty penny. He’s a sure bet for employee of the month this time round.

Fleet manager action:

Clone drivers like this! They are your best assets when it comes to claims containment and the ones who will keep your premiums as low as possible. Use them as an example to others and reward them. Everyone loves an ‘employee of the month’ accolade!

Ian McCarron, director at McCarron Coates, says: “If operators use our avatars to identify the different types of claims reporter they have in their ranks, they can work on the issues that underpin late claims reporting and eradicate this from the organisation. They will become the sort of risk insurers wish to insure, which means premiums will be as low as possible for the operator.”

Paul Coates adds: “Every driver will have different reasons for not taking on board claims-reporting guidance, but recognise these, press the right buttons, and you can transform your claims reporting. That will pay off when it comes to insurance renewal time, when you pocket the financial benefit of having understood the psyche of your driver, their weakspots and how they are likely to respond to a bump, scrape or worse.”

McCarron Coates offers other assistance with claims containment and even assists large operations with their driver recruitment, to get the right people behind the wheel from the get-go. If you need help with claims containment, contact Ian McCarron or Paul Coates on 0113 298 3489 or email info@mccarroncoates.com